This article was first published on LinkedIn as part of the Signals over Noise newsletter.

Traditional customer surveys often start with good intentions but end with misleading data. It's like checking the weather app, seeing a "0% chance of rain" forecast, and then getting soaked in a thunderstorm.

Case in Point: The Sustainability Factor

For years, various surveys have suggested that sustainability is a key driver—and often a very important one—behind consumer decisions to buy electric vehicles (EVs) in Southeast Asia:

Exhibit A - Euromonitor, on 31 July 2025, published:

“Environmental consciousness has become a mainstream motivator for Southeast Asian consumers. […] In Indonesia, this sentiment is particularly strong, with 73% citing sustainability as a primary reason for considering an EV. Singapore (63%) and Thailand (59%) also show above-global-average alignment.”

Source: Euromonitor

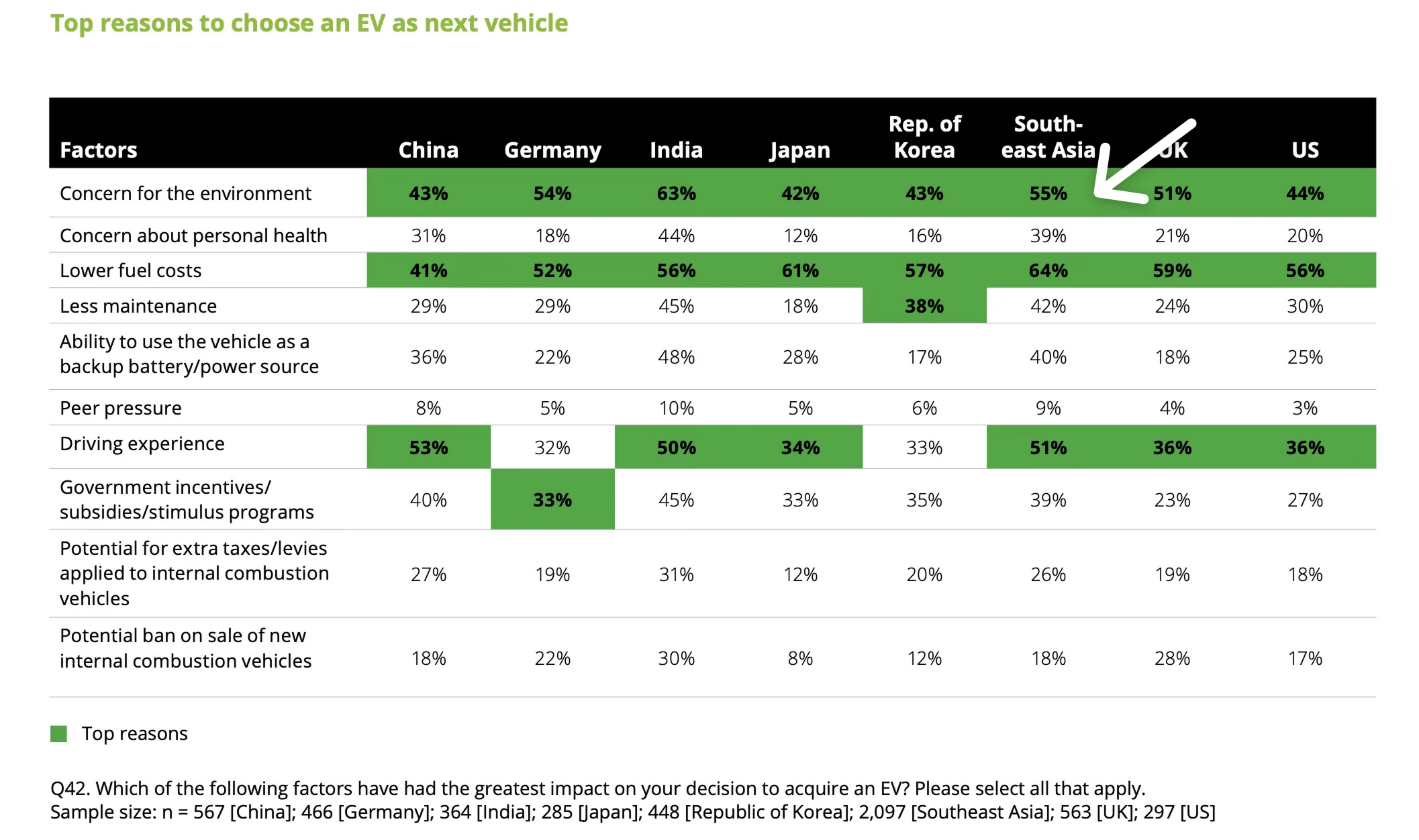

Exhibit B - Deloitte, in its Global Automotive Consumer Study, has consistently ranked “concerns for the environment” among the top reasons “to choose an EV as the next vehicle.” In the latest 2025 version, 55% of respondents in Southeast Asia selected this option—the second-highest score, behind lower fuel costs.

Source: Deloitte

Some consultants mentioned sustainability as a factor, but placed its importance lower:

Exhibit C - In June 2023, McKinsey published:

"For auto consumers from the region, McKinsey research across ASEAN suggests TCO remains the top concern for adoption of EVs, whereas environmental friendliness is a weaker demand driver of mass-market adoption, behind cost, prestige, and technology."

Source: McKinsey

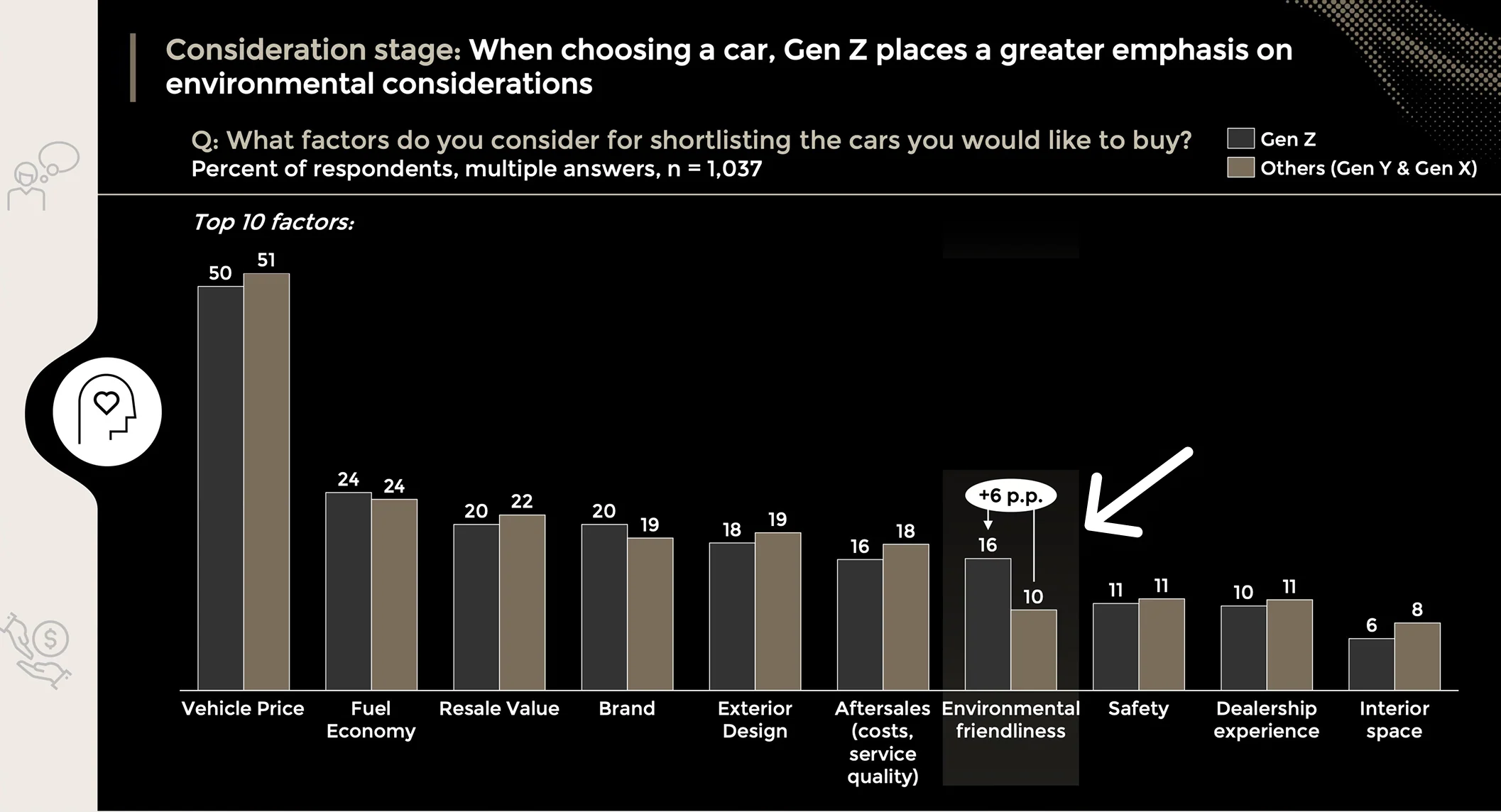

Exhibit D - In May 2023, ABeam Consulting published research based on respondents from Thailand and Indonesia. It showed that 16% of Gen Z respondents and 10% of other generational cohorts consider environmental friendliness a factor when deciding which cars to shortlist.

Among those specifically interested in fully electric vehicles, 35% of Gen Z and 18% of other cohorts mentioned environmental reasons (the average across all ages being 24%).

Full disclosure: I personally designed this survey and selected the vendor to get inputs from respondents.Source: ABeam Consulting

The Discrepancy: Surveys vs Reality

All these surveys asked slightly different questions and offered different sets of options. But, in essence, they aimed to do the same thing: give automakers a clearer picture of what matters to car buyers in Southeast Asia. They all spotlight the environment—but the surveys vary widely in how much importance respondents seem to place on it.

Because of these differences, my inner Dr. House is screaming to grab a whiteboard and dig into the root causes. The instinct is to order a full diagnostic examination on the methodologies, screen the respondents, and biopsy the questions' phrasing in Bahasa Indonesia versus Thai.

But then comes the classic House epiphany. We're looking in the wrong place altogether. The problem isn't that the results differ. The problem is that they're all significantly higher than zero. Why? Because:

Environmental factors, contrary to what surveys suggest, are virtually absent from organic discussions.What People Really Think about Sustainability is...Nothing?

Over the past 12 months, I’ve personally browsed through thousands of public online conversations and built AI tools to get a bird’s-eye view of what people say about cars, with the biggest focus on Thailand. Across these discussions, I’ve seen hundreds of threads about vehicle prices, maintenance schedules, reliability, aftersales service, the costs of electricity and fuel, charging issues, infotainment systems, and countless other practical topics.

What I haven’t seen are conversations about someone buying an EV “because it’s good for the environment” or wondering which model is “the most sustainable.” In the diagnostic world of Dr. House, it's never lupus. In the world of real car-buying factors, it’s never sustainability.

So, Why the Gap Between Surveys and Reality?

First, consultants and researchers are naturally biased by macro-trends. It would feel almost negligent for a survey report to ignore sustainability—the very narrative that underpinned the development of electric vehicles in the first place.

But beyond that, there are issues one needs to be aware of from the perspective of respondents, including:

- Survey Design Bias. The structure of a survey question heavily shapes the answers it produces. For example, a “select all that apply” format measures passive agreement, not active priority. A more revealing approach would use trade-off questions—such as, “Would you sacrifice 50 kilometers of range (400 → 350 km) for a battery produced with 50% lower CO₂ emissions?” Such designs force respondents to confront real compromises and significantly constrain options, but are complicated in design and require respondents to answer tens of questions to cover all key possibilities.

- The Say-Do Gap and Social Desirability Bias. What people say in surveys often diverges from what they actually do. Stated preferences reflect aspirations and self-image. Some respondents answer in ways that align with socially desirable values rather than their true feelings. If “environment” is listed as an option, many will select it simply to project responsibility or virtue. It’s an easy, feel-good choice that flatters identity more than it reveals intent.

Traditional Surveys: Handle with Care

There's a danger in treating survey numbers as unquestionable truths, particularly after investing resources that can trigger the sunk cost fallacy. A tidy statistic can oversimplify messy human behavior, leading companies to chase the wrong priorities while ignoring what actually drives decisions.

Consider Euromonitor's recommendation for automakers to "emphasise the sustainability and cost-saving benefits of EVs, while addressing affordability and infrastructure concerns head-on." It's a logical suggestion based on their data, but it's built on a faulty foundation. When the data doesn't reflect reality, such recommendations are set to yield disappointing results.

Rethinking Research: A Better Playbook

The way we do research needs an upgrade.

Well-designed surveys aren’t useless, but they are limited. They only answer the questions you pose, and their biggest weakness is what they can't do: surface the crucial questions you never thought to ask.

This is where organic online discussions provide a powerful starting point. They offer lens into what people care about when no one is prompting them, revealing the true priorities that shape their behavior.

Flipping the traditional model—by starting with social listening—is both efficient and revelatory. You often find the answers to your initial questions without ever having to field a survey, saving time and money. More importantly, you discover the real questions—the topics, pain points, and motivations that were never on your radar. This is the raw material for building smarter, more relevant surveys next.

Closing Thoughts

Listen first, ask later. To truly understand consumers, we must balance the polished numbers of surveys with the raw, unfiltered reality of organic conversations. That’s where the real truth is found—and where the best decisions begin.